CM Punjab Parwaz Card

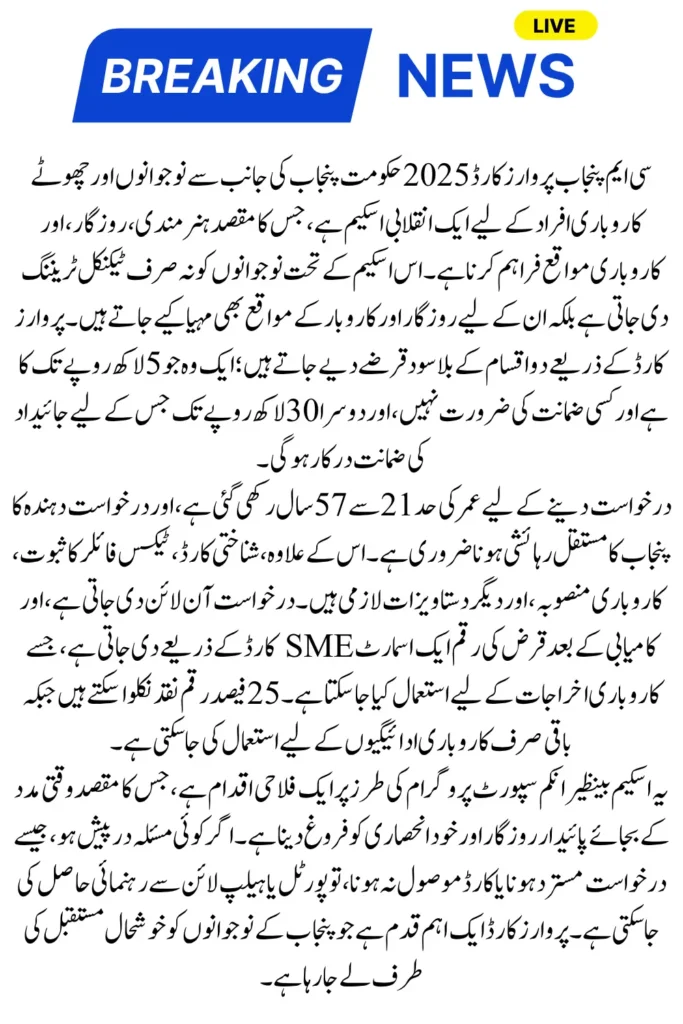

The CM Punjab Parwaz Card Scheme is a youth-focused initiative under the provincial development agenda of Punjab. Designed to enhance technical skills and employability, the Parwaz Card provides registered youth with specialized training programs and support aimed at securing good jobs or starting business ventures. It builds on the broader social investment strategy of Chief Minister Maryam Nawaz Sharif across the province for education, access to jobs, and the well-being of the youth.

The scheme reflects the government’s move towards inclusive economic development. Along with initiatives like Himmat Card, Minority Card, and Labor Card, Parwaz Card also targets youth with vocational training and certification, with the aim of providing meaningful employment rather than temporary relief and providing jobs to the poor so that Pakistan can prosper and everyone can have a better future in their lives.

Parwaz Card Registration Portal Launched

The Punjab Government has officially launched the Parwaz Card Registration Portal at parwaaz.psdf.org.pk to make the registration process easy, transparent, and fully online. Through this portal, eligible applicants can apply from home without visiting offices or paying any agent. The government aims to ensure quick verification and fair access to opportunities under the Parwaz Card program by using a digital system managed by Punjab Skills Development Fund (PSDF).

You Can Also Read:Get Taxi Via CM Punjab Green E-taxi Program on 0% Markup

Business loan facilities under CM Punjab Parwaz Card

CM Punjab Parwaz Card Scheme also provides business loan facilities, which aim to empower youth and small business people in Punjab. Under the scheme, two types of interest-free loans are provided, which are listed below:

- Loans up to PKR 500,000 will be available without the need for collateral

- Loans up to PKR 3,000,000, which require property or asset-based security.

You Can Also Read:CM Punjab Laptop Scheme Phase 2 Important Updates for Students

Eligibility criteria for CM Punjab Parwaz Card application

To be eligible for the CM Punjab Parwaz Card, follow these conditions:

- To be eligible for this scheme, the age should be between 21 and 57 years

- Must be a permanent resident of Punjab

- Must have your valid CNIC and a valid registered Shoda mobile number

- Must have a plan to do business in Punjab

- Must be a registered tax filer with a clean credit history

Know that you can be eligible for this scheme by following these conditions, and make sure that only eligible people can get interest-free business loans under the scheme.

You Can Also Read:Kisan Card loan Limit Increase up to 10 Acres Register Now to get a Loan

Documents required for CM Punjab Parwaz Card

Here is the list of essential documents required to apply for the CM Punjab Parwaz Card Business Loan:

- Make sure to have front and back copies of CNIC, as well as a passport-size photograph

- Proof of tax filing

- Business income and expense statements are mandatory, such as bank or sales records, etc.

- Bring proof of business and residential address

- CNIC copies and contact details for personal or business referees

That’s all you need, and know that before uploading to the portal, make sure that all documents are clear digital scans.

You Can Also Read:Apni Chat Apna Ghar Scheme New Registration

Parwaz Card Registration Process (Step by Step)

Follow these simple steps to register on the Parwaz Card portal:

- Visit the official website parwaaz.psdf.org.pk

- Click on the Parwaz Card Registration option

- Enter your personal details such as name, CNIC, and mobile number

- Provide educational or skill-related information (if required)

- Upload necessary documents carefully

- Review your details and submit the application

- You will receive a confirmation message after successful submission

After submission, authorities will verify the information, and eligible applicants will be informed about the next steps through official channels.

How to use the CM Punjab Parwaz card after approval?

Once approved, the Parvez Card works like a smart debit card. You can use it to pay for business-related expenses such as purchasing equipment, paying utility bills, or covering vendor payments. Up to 25% cash withdrawal is allowed for flexible needs, while the rest must be spent digitally. The card ensures transparent, interest-free credit utilization and easy tracking of spending, and repayments begin after a grace period.

You Can Also Read:Apni Chhat Apna Ghar Scheme Phase 2 – 15 Lakh Loan for Home

Solutions to common problems encountered in the CM Punjab Parwaz Card application

- Application rejected: Review eligibility, tax status, and document accuracy before reapplying.

- Delayed approval: Ensure all documents are complete and follow up through the portal or helpline.

- Card not received: Contact Bank of Punjab or track via courier with your reference number.

- Login issues: Reset password or clear browser cache. Use mobile linked to CNIC.

- Loan not usable: Use card for approved business payments only. Avoid non-business usage to prevent blocking.

You Can Also Read:Required Documents and Registration Process For the Green E-Taxi Scheme

Frequently Asked Questions

Who can apply for the Parwaz Card?

Any resident of Punjab aged 21 to 57 with a valid CNIC, active tax status, and a business idea or existing setup can apply.

Is the loan completely interest-free?

Yes, all loans provided under the Parwaz Card are 100% interest-free.

What is the maximum loan amount?

You can get up to PKR 3,000,000, depending on your eligibility and business needs.

How will I receive the loan?

The approved amount is issued through a smart SME card, which can be used for business transactions.

Can I withdraw cash from the card?

Yes, you can withdraw up to 25% of the loan amount in cash; the rest must be spent digitally.

What happens if I miss a repayment?

Missing repayments may lead to penalties and could affect your credit history. It’s important to repay on time.

You Can Also Read:Punjab Green Taxi Scheme Registration Date and Requirements Revealed

Conclusion

CM Punjab Perwaz Card 2026 is a bold step towards empowering youth, small businesses and aspiring entrepreneurs across Punjab. With interest-free loans, digital SME cards, and a transparent system, it opens new doors to financial freedom and economic growth. Whether you are starting a new business or expanding an existing one, Parwaz Card provides the support you need safely, smartly and without burden.